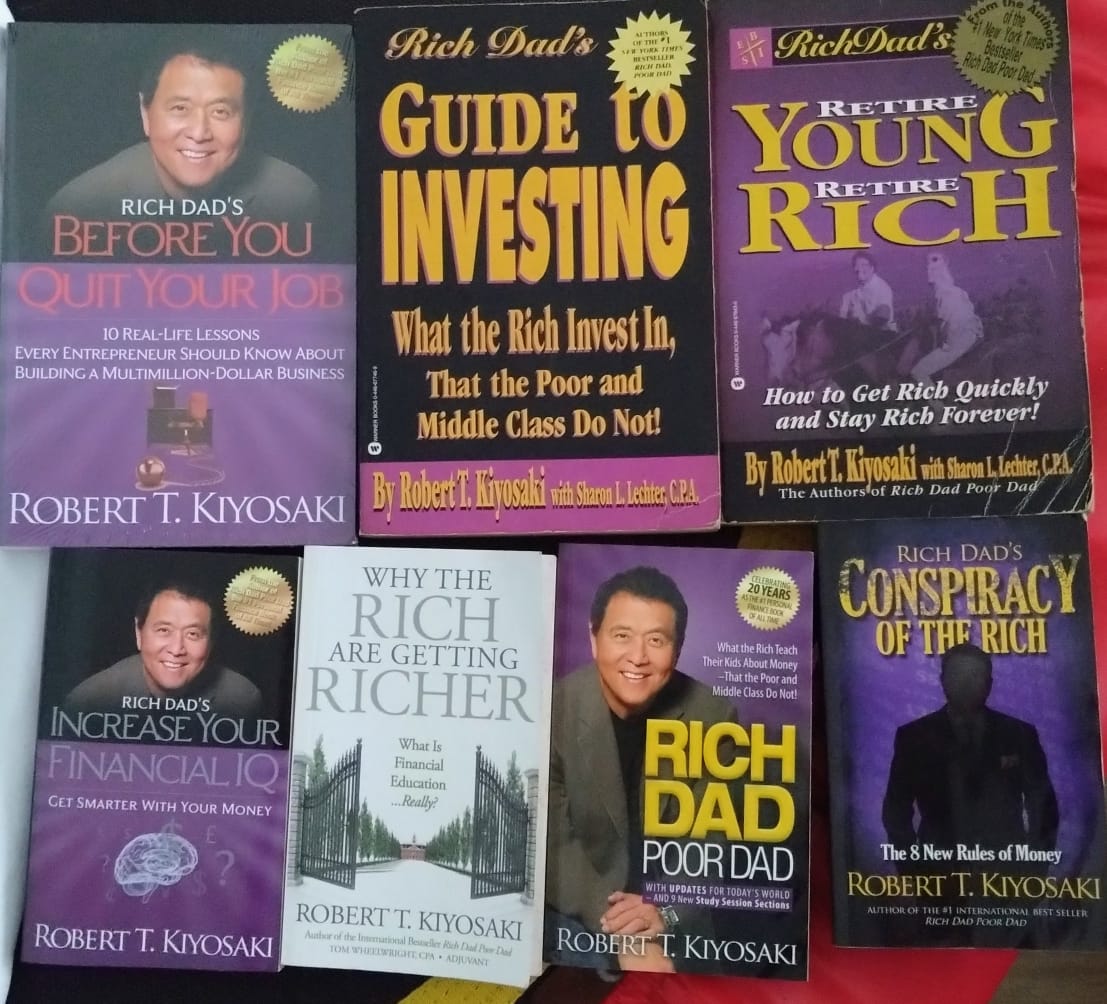

Rich Dad Poor Dad was the first book I read from Robert Kiyosaki‘s series of books. It is a good personal finance book, and it let me understand the mindset of the rich vs. the poor (based on the book’s context). Then I read other books like Cashflow Quadrant, Retire Young Retire Rich, Guide to Investing, and so on. From what I Googled, he has authored more than 20 books. So many books, and which one to read first? In my opinion, you can start with the books below first.

Top 6 Rich Dad Books to Read

- Most Practical – Cashflow Quadrant (1998)

Why? Explains the four quadrants: Employee, Self-Employed, Business Owner, Investor.

Teaches where wealth really comes from and why shifting quadrants is key.

Gives a framework for career/investing decisions.

Best for: People serious about building wealth beyond a job.

- Foundational – Rich Dad Poor Dad (1997)

Why? The classic starter. Explains assets vs liabilities, mindset differences between rich and poor.

Motivational but also introduces core principles.

Best for: Beginners needing a mindset shift about money.

- Intermediate – Guide to Investing (2000)

Why? Focuses on how the rich think about investments.

Not technical, but emphasizes building income-generating assets.

Best for: Readers ready to move beyond theory into applying investing principles.

- Niche but Practical – Rich Kid Smart Kid (2001)

Why? Focused on raising financially literate children.

Good if you have kids or teach others. Otherwise, less relevant.

Best for: Parents/teachers who want to instill financial education early.

- Warning/Motivational – Rich Dad’s Prophecy (2002)

Why? Talks about market crashes, retirement system risks, and preparing for crises.

Useful for awareness, but not a step-by-step manual.

Best for: Readers worried about retirement funds and economic downturns.

- Mindset Reinforcement – Rich Dad’s Guide to Becoming Rich (2000)

Why? Focuses on debt and credit (good vs bad debt).

Repeats a lot of Rich Dad Poor Dad, but useful if you struggle with debt mindset.

Best for: Beginners who fear credit cards or debt.

Financial Education Path by Age Group

Choosing which book to read first can also depend on your age group or if you’re a parent of young children or teenagers. Here are suggestions for a financial education path by age group, based on Robert Kiyosaki’s Rich Dad series. This way, you can see which books fit best for kids, teens, young adults, and adults.

Kids (7–12 years old) or Parent

Goal: Build curiosity about money and basic understanding.

🎲 Cashflow for Kids (board game) → Fun way to teach assets vs liabilities.

📖 Rich Kid Smart Kid (for parents to guide kids)

Parents use stories, games, and simple lessons to teach the basics.

Focus on values, mindset, and money as a language.

Teens (13–19 years old) or Parent

Goal: Learn the basics of money, choices, and entrepreneurship.

📖 Rich Dad Poor Dad for Teens

Introduces assets vs liabilities in simple terms.

Motivates teens to think beyond school → job → paycheck.

📖 Optional: Rich Kid Smart Kid (if parents want to guide them more deeply).

🎲 Cashflow 101 Game (teen/adult version) → Great practical reinforcement.

Young Adults (20–30 years old)

Goal: Shift mindset from “employee” to investor/entrepreneur.

📖 Rich Dad Poor Dad (foundation book).

Essential mindset shift: understand wealth-building basics.

📖 Cashflow Quadrant

Most practical book in the series → shows difference between Employees, Self-Employed, Business Owners, Investors.

Guides readers on moving from job-income to building wealth.

📖 Rich Dad’s Guide to Becoming Rich (if struggling with debt/credit).

Adults (30+ years old)

Goal: Build, scale, and protect wealth.

📖 Rich Dad’s Guide to Investing

Focused on mindset and strategy for long-term investors.

📖 Rich Dad’s Prophecy

Prepares for retirement challenges and market downturns.

📖 Supplementary Reading: The Real Book of Real Estate (by Kiyosaki and advisors)

More advanced and detailed than his earlier books, practical for investors.

Final Thoughts

- Best Starting Point: Rich Dad Poor Dad (mindset foundation).

- Most Practical / Action-Oriented: Cashflow Quadrant.

- For Parents: Rich Kid Smart Kid.

- For Long-Term Investing Mindset: Guide to Investing.

- For Crisis Thinking: Prophecy.

- For Debt Mindset: Guide to Becoming Rich.

- Parent with kids

- Kids: Rich Kid Smart Kid

- Teens: RichDad for Teens